In the ever-evolving world of finance, a groundbreaking development has emerged at the intersection of traditional investment vehicles and the revolutionary realm of digital currencies. This development is known as Bitcoin ETFs, or Bitcoin Exchange-Traded Funds. At its core, a Bitcoin ETF combines the time-tested structure of an exchange-traded fund with the innovative, digital landscape of cryptocurrencies, specifically Bitcoin. By doing so, it bridges the gap between conventional investment methods and the new age of digital assets, offering a unique opportunity for investors to participate in the Bitcoin market through a format that is familiar and regulated.

Discussion Overview: The Role of Bitcoin ETFs in Modern Investment

Bitcoin ETFs represent a significant milestone in the financial world, marking the integration of one of the most volatile and exciting assets of our time into a more accessible and regulated framework. These funds are designed to track the performance of Bitcoin, providing investors with an indirect exposure to Bitcoin’s price movements without the complexities of managing a digital wallet or understanding blockchain technology. This integration plays a pivotal role in legitimizing cryptocurrencies as a viable asset class, offering a new avenue for investors to diversify their portfolios, hedge against inflation, or simply gain exposure to the potential growth of digital currencies.

Objectives: Enlightening the Investment Community

Our goal with this article is not just to introduce Bitcoin ETFs but to delve deep into their mechanics, implications, and potential impact on investment strategies. We aim to provide a comprehensive guide for both seasoned investors and newcomers alike, covering everything from the basics of what Bitcoin ETFs are to the intricacies of how they operate. This article is crafted to enlighten, inform, and guide you through the complexities of Bitcoin ETFs, helping you understand their place in your investment portfolio, the risks they carry, and the opportunities they present.II. Understanding Bitcoin ETFs: A Comprehensive Guide

Definition and Functioning: The Mechanics of Bitcoin ETFs

Bitcoin ETFs are a type of exchange-traded fund that primarily invests in Bitcoin or related financial instruments. These funds operate by purchasing Bitcoin directly or through derivatives like futures contracts, aiming to mimic the performance of Bitcoin’s market price. Investors buy shares of the ETF on a stock exchange, similar to how they would purchase shares of any publicly traded company. This approach provides the advantage of trading Bitcoin like a stock, bypassing the need for a cryptocurrency exchange account or a digital wallet. By doing so, Bitcoin ETFs open the doors to digital currency investments for a broader range of investors, especially those who prefer traditional brokerage accounts.

Benefits and Risks: Navigating the Bitcoin ETF Landscape

Investing in Bitcoin ETFs offers several benefits, including ease of access, increased liquidity, and the security of dealing with regulated financial entities. It simplifies the process of investing in Bitcoin, making it as straightforward as buying stocks. Moreover, these ETFs provide the advantage of liquidity, as shares can be quickly bought and sold during trading hours at market prices. However, like all investments, Bitcoin ETFs also carry risks. The most prominent is the inherent volatility of Bitcoin itself. The price of Bitcoin can fluctuate wildly due to factors like regulatory news, technological advancements, and market sentiment. Additionally, as a relatively new investment vehicle, Bitcoin ETFs may be subject to regulatory changes.

Comparison with Direct Bitcoin Investment: ETFs vs. Owning Bitcoin

Investing in a Bitcoin ETF differs fundamentally from owning Bitcoin directly. When you invest in a Bitcoin ETF, you own shares of a fund that tracks the price of Bitcoin, not the Bitcoin itself. This means you don’t have to deal with the technicalities of purchasing, storing, and securing Bitcoin, nor do you need to worry about the challenges of transacting on cryptocurrency exchanges. However, this also means you miss out on certain benefits of direct ownership, such as the potential for participating in the Bitcoin network and having full control over your digital assets. For many investors, the trade-off between convenience and control is a crucial factor in deciding between Bitcoin ETFs and direct Bitcoin investment.

The Evolution of Bitcoin ETFs: A Market Overview

Historical Perspective: The Advent of Bitcoin ETFs

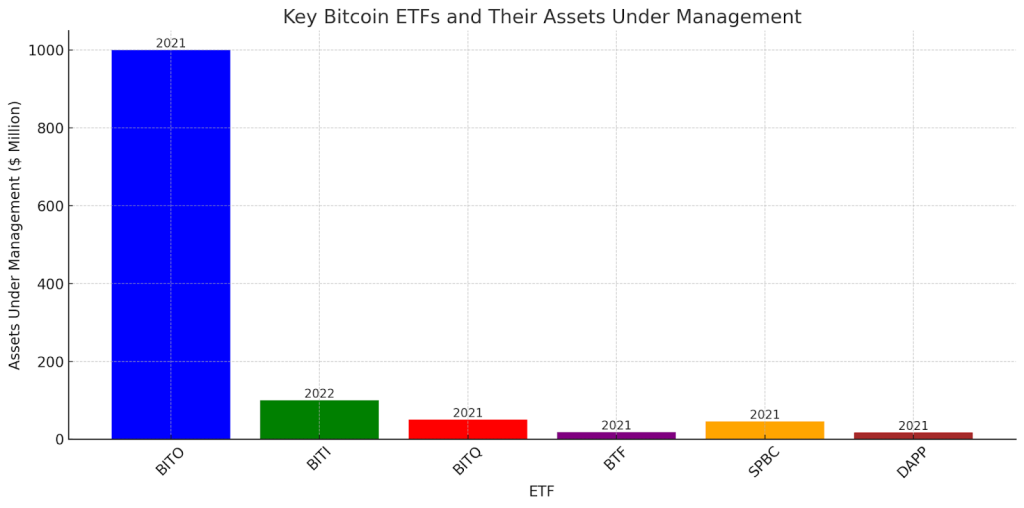

Bitcoin ETFs have rapidly evolved since their inception, becoming a crucial part of the investment landscape. The first Bitcoin-linked ETF in the United States, the ProShares Bitcoin Strategy ETF (BITO), was approved by the SEC in 2021. It marked a significant milestone, accumulating over $1 billion in assets in just two years. This early success paved the way for various innovative ETFs, each catering to different investment strategies within the cryptocurrency domain.

Market Trends and Analysis

The Bitcoin ETF market has seen diverse growth, with funds like BITO focusing on Bitcoin futures to track Bitcoin’s price without direct investment in the cryptocurrency. The ProShares Short Bitcoin ETF (BITI), launched in 2022, offers an opportunity for investors to profit from Bitcoin’s price drops, highlighting the market’s expanding versatility. The Bitwise Crypto Industry Innovators ETF (BITQ), although not exclusively a Bitcoin ETF, provides a broader exposure to the crypto and blockchain industry, reflecting the sector’s increasing depth and complexity.Other noteworthy ETFs include the Valkyrie Bitcoin Strategy ETF (BTF) and the Simplify U.S. Equity PLUS GBTC ETF (SPBC), which blend traditional investment with exposure to Bitcoin, illustrating the market’s innovative approaches to integrating cryptocurrencies into mainstream investment vehicles. The VanEck Digital Transformation ETF (DAPP) tracks companies involved in the digital asset and blockchain industries, offering investors a mix of risk and potential rewards.

Key Players and Products

The market is characterized by a variety of Bitcoin ETFs, each with unique strategies and focuses:

- ProShares Bitcoin Strategy ETF (BITO): Pioneering the U.S. Bitcoin ETF market with a focus on Bitcoin futures.

- ProShares Short Bitcoin ETF (BITI): Offering opportunities for investors to profit from Bitcoin’s price declines.

- Bitwise Crypto Industry Innovators ETF (BITQ): A broader crypto and blockchain industry ETF, not limited to Bitcoin.

- Valkyrie Bitcoin Strategy ETF (BTF): An actively managed ETF investing in Bitcoin futures and U.S. treasury bills.

- Simplify U.S. Equity PLUS GBTC ETF (SPBC): Mixing traditional U.S. securities with exposure to Bitcoin through the Grayscale Bitcoin Trust.

- VanEck Digital Transformation ETF (DAPP): Tracking companies in the digital assets and blockchain industries.

These ETFs represent the diverse strategies and approaches within the Bitcoin ETF market, catering to various investor preferences and risk appetites.

How to Invest in Bitcoin ETFs

Investing in Bitcoin ETFs marries the familiarity of traditional investment methods with the innovative world of digital assets. This process starts with selecting a brokerage that offers access to Bitcoin ETFs, such as BITO, BITI, or BITQ, among others. After setting up and funding your brokerage account, the next step is to research the various Bitcoin ETFs available, understanding their unique strategies, fee structures, and performance histories.It’s crucial to thoroughly understand the risks involved, particularly the volatility inherent in Bitcoin and the wider cryptocurrency market. With your chosen ETF in mind, you can then purchase shares through your brokerage platform, keeping in mind the number of shares you wish to buy should align with your investment strategy and risk tolerance.Once invested, it’s essential to regularly monitor the performance of your Bitcoin ETF, staying abreast of cryptocurrency market trends and global economic factors that might influence your investment. Choosing the right Bitcoin ETF requires careful consideration of several factors, including the ETF’s investment strategy (whether it invests directly in Bitcoin, Bitcoin futures, or companies related to blockchain and crypto industries), your personal risk tolerance, the fund’s expense ratios and fees, its performance history, and the liquidity of the ETF for easy buying and selling of shares.This approach to investing in Bitcoin ETFs offers a structured path for investors to tap into the potential of Bitcoin while leveraging the stability and familiarity of traditional exchange-traded funds.

Bitcoin ETFs in Practice: A Listicle

Top Bitcoin ETFs to Watch

The world of Bitcoin ETFs is vibrant and diverse, offering various options for investors. Key ETFs in the market include:

- ProShares Bitcoin Strategy ETF (BITO): A trailblazer in the U.S. Bitcoin ETF space, BITO focuses on Bitcoin futures, aiming to track Bitcoin’s price movements without direct cryptocurrency investment.

- ProShares Short Bitcoin ETF (BITI): Designed for investors looking to profit from potential drops in Bitcoin prices, BITI offers a unique short-selling approach.

- Bitwise Crypto Industry Innovators ETF (BITQ): This ETF expands beyond Bitcoin, investing in companies across the crypto and blockchain sectors, offering a diversified crypto-related investment.

- Valkyrie Bitcoin Strategy ETF (BTF): BTF is an actively managed ETF that invests in Bitcoin futures and U.S. Treasury bills, providing a blend of digital and traditional assets.

- VanEck Digital Transformation ETF (DAPP): DAPP focuses on companies actively involved in digital assets and blockchain, offering exposure to the broader digital asset ecosystem.

Success Stories

While specific investor success stories with Bitcoin ETFs are varied and depend on individual investment strategies and market timing, the general trend has been positive. For instance, investors who entered the market early with ETFs like BITO have seen significant returns, particularly during Bitcoin’s price surges. The success of ETFs like BITQ and DAPP also highlights the potential of diversified investment strategies, tapping into the broader growth of the crypto and blockchain industries.

The Impact of Bitcoin ETFs: A Thought Leadership Piece

Bitcoin ETFs have significantly influenced the broader cryptocurrency market, serving as a bridge between traditional financial systems and the dynamic world of digital currencies. These innovative financial instruments have legitimized Bitcoin investments, offering a regulated and familiar entry point for a wide range of investors. This has not only broadened investor access but also played a role in stabilizing and shaping Bitcoin prices, as these ETFs represent substantial market interest in Bitcoin.Looking ahead, the future of Bitcoin ETFs is intertwined with the evolution of financial markets and digital currencies. Their increasing adoption suggests a growing recognition of cryptocurrencies as a legitimate asset class. Innovations in ETF offerings are likely, including those with diversified exposure to various cryptocurrencies or blockchain technologies. Regulatory developments will continue to influence the Bitcoin ETF market, potentially opening new opportunities or posing challenges. In essence, the trajectory of Bitcoin ETFs will significantly impact how cryptocurrencies are perceived and utilized in the global financial ecosystem, making them a pivotal element in the future of investment portfolios.

Some FAQs Answered On The Relevant Topic

What is a Bitcoin ETF? A Bitcoin ETF is an exchange-traded fund that tracks the price of Bitcoin or invests in Bitcoin-related assets, allowing investors to invest in Bitcoin without directly purchasing and storing the cryptocurrency.Are Bitcoin ETFs risky? Like any investment, Bitcoin ETFs carry risk, primarily due to the volatility of Bitcoin’s price. However, they offer a regulated and more accessible way to invest in Bitcoin.How do I invest in a Bitcoin ETF? You can invest in a Bitcoin ETF through a brokerage account, just like you would invest in any other ETF or stock.Can I use a Bitcoin ETF for long-term investment? Yes, some investors use Bitcoin ETFs as part of their long-term investment strategy, especially as a way to diversify their portfolio.In conclusion, Bitcoin ETFs represent a significant development in the financial world, offering a bridge between traditional investment methods and the burgeoning world of digital currencies. These ETFs provide a regulated, accessible, and diverse way to invest in the cryptocurrency market, whether through direct Bitcoin tracking or broader exposure to crypto-related industries. As we look to the future, the role of Bitcoin ETFs in investment portfolios is likely to grow, reflecting the increasing integration of digital assets into the mainstream financial landscape.

Eric Dalius is The Executive Chairman of MuzicSwipe, a music and content discovery platform designed to maximize artist discovery and optimize fan relationships. In addition, he hosts the weekly podcast “FULLSPEED,” where he interviews innovative entrepreneurs across multiple industries. Eric also established the “Eric Dalius Foundation” to provide four scholarships for US-based students. Connect with him on Twitter, Facebook, LinkedIn, Instagram, and Entrepreneur.com.